Get ready to fork over more of your hard earned money next year to cover Jasper’s $16.5 million operating budget in 2017.

The budget proposes increasing municipal taxes by 3.01 per cent as well as increasing utility rates next year.

The proposed tax increase could be reduced by 0.5 per cent thanks to a $37,000 tax over levy that was approved in 2016, however it will depend on how many properties try to appeal their property assessments next year. The money will be applied to the 2017 tax rate when the bylaw is set in June.

Jasper’s 2017 municipal budget is about $800,000 more than last year.

This will be covered by $9.1 million in offsetting revenues and $7.4 million in municipal taxes. A 3.01 per cent tax increase equates to an overall revenue increase of $215,929 for 2017.

For a property assessed at $750,000, a 3.01 per cent tax increase would equate to a $135 tax hike, bringing the homeowner’s annual municipal tax bill to $4,635. Bi-monthly utilities bills would also increase by $9.52 to $156.77 for the average residential user every two months.

For a commercial property assessed at $1 million, a 3.01 per cent tax increase would increase the property’s annual tax bill by $467 for an annual bill of $15,967. The jump in utilities would increase a business’ bi-monthly utilities bill by $286.26 to $9,185.10.

Utilities include water, sewer, garbage and recycling and are funded through a user pay model and do not directly affect the municipal tax rate.

This year the municipal tax rate was decreased by 0.7 per cent by ensuring utilities were cost recovered.

This is the first time the municipality has put together a three-year operating budget, which will soon become a mandate for all municipalities under Alberta’s Municipal Government Act.

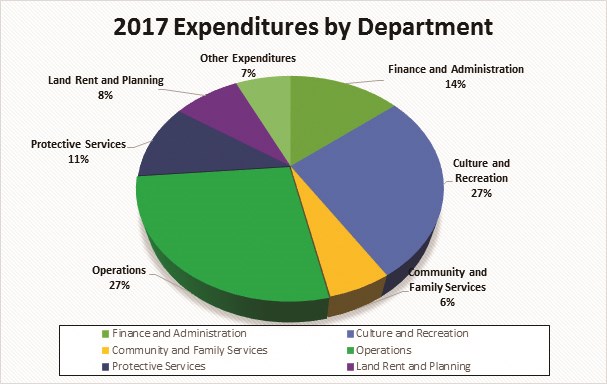

Council heard from the director of each of the municipality’s departments during budget deliberations on Nov. 28 and 29. Outlined below is a brief overview of each department’s operating budget for 2017.

Council will make a final decision on this year’s budget in the New Year once year-end numbers are available. In the meantime, council will pass an interim budget on Dec. 20 to ensure administration can continue to operate as normal.

Culture and Recreation

2017 budget: $1.98 million

Increase: $52,417 or 2.7 per cent

The cultural and recreation department will require $1.98 million in municipal taxes, including an additional $52,417 in 2017 to cover an increase in salaries and benefits, arena improvements and annual maintenance costs for the bike park.

Included in the department’s budget is a request from the library for $188,745, including $25,000 in additional funding for 2017.

The department’s budget also includes a $49,000 request from the Jasper-Yellowhead Museum and Archives.

In the year ahead the department will have a lot on its plate, including the redevelopment of Centennial Field which will cost $200,000 in capital funding.

In August 2015, the federal government earmarked $187,500 to put toward the redevelopment of the field on the condition that the municipality would match those funds.

According to Yvonne McNabb, director of the department, the field is in such bad shape that the soccer association is no longer allowed to play games on the field.

Construction is scheduled to begin on July 2, 2017 the same day the department intends to begin booking activities for the exchange lands.

While Centennial Field is being rehabilitated, the department will also have to find a new location for the Dark Sky Festival next fall.

Other capital projects next year include replacing the heating units in the arena’s stands, replacing two backstops at the baseball diamonds, replacing the cabin creek playground, and replacing two heating and ventilation units on the Activity Centre’s roof.

In total the department would like to spend $385,000 on capital projects next year.

Looking forward to 2018, the department has even bigger plans, including a complete overhaul of the arena, aquatic centre, curling rink and the Jasper Activity Centre’s multi-purpose hall.

If approved, the total price tag for the projects will cost $6.6 million in capital funding and require the municipality to borrow money.

The plan would also require the arena to be closed in the off-season to replace the arena’s floor, boards, overhead lighting and compressor room. There is also a plan to add an additional dressing room.

Construction at the aquatic centre will also require a significant shut down in 2018 so the municipality can replace the water slide, stairs, HVAC system, mechanical room and the aquatic centre’s windows and doors.

McNabb estimates the pool could be closed for up to three months to complete the work in 2018.

Operations

2017 budget: $1.99 million

Increase: $29,096 or 1.48 per cent

The operations department, which is responsible for everything from the town’s roads and sidewalks to sewage and garbage, will require nearly $2 million in municipal taxes, including an additional $29,096 in 2017.

According to Bruce Thompson, director of operations, the additional money will cover an increase in salaries and benefits, fuel costs, fleet maintenance and consulting fees.

In 2017 the department will continue to focus on its asset management plan, wayfinding program and deal with the town’s growing pile of biosolids at the transfer station.

In addition to its operating budget, Thompson also put forward the department’s five-year capital budget for operations, which includes spending $1.14 million in 2017.

Some of the items on that list include spending $250,000 to replace aging vehicles, $100,000 for a transportation study, $200,000 for the first phase of the wayfinding program and $300,000 to reconfigure the intersection of Miette Avenue and Turret Street into a four-way stop.

Smaller capital projects in 2017 include, $40,000 for three electronic radar boards, $20,000 for a Robson Park master plan, $35,000 for a seasonal waterline for the bike park and $20,000 to do sonar work at the cemetery to avoid having to expand it.

The capital budget for utilities in 2017 includes spending about $686,000, including $250,000 to replace aging vehicles and $30,000 to replace garbage bins in town.

Finance and administration

2017 budget: $1.04 million

Increase: $93,812 or 9.8 per cent Â

The finance and administration department will require more than $1 million in municipal taxes, including an additional $93,812 in 2017.

The budget increase will cover a range of costs including next year’s municipal election, software upgrades, replenishing the Economic and Community Development Fund and wage/benefit increases.

The department has also asked for $40,000 to be earmarked for the Tour of Alberta next summer, which municipal council will vote on in the New Year.

As for capital projects, next year the department would like to spend $44,000 to access the Axia Supernet, the province’s fibre-optic Internet system and another $33,000 to buy a new computer server.

“It’s been very frustrating for users and slows down productivity,” said Natasha Malenchak, the director of finance, about the municipality’s current Internet service.

According to Malenchak, the server and the fibre optic system could be covered by a provincial grant.

The department is also requesting $5,000 for office renovations, $20,000 to complete a housing study and $35,725 to pay for a CN warning system for a railroad crossing.

Community and Family Services

2017 budget: $409,695

Increase: $6,268 or 1.6 per cent Â

Community and Family Services accounts for the smallest share of the municipality’s annual budget despite the fact that it manages an annual operating budget of $2.2 million.

The secret to its success has been the department’s ability to leverage its municipal funding to apply for government grants.

According to its 2017 budget, the department will require about $410,000 in municipal taxes, including an additional $6,268 to cover salary increases.

The municipal funding pays for the tangible costs to run the department while provincial funding and grants pay for the department’s salaries and programs.

The municipal contribution also includes an $11,838 contribution to Jasper Victim Services.

The 2017 budget also includes $70,880 for the cost to provide daily meals at the daycare centre. If approved, the cost will be passed on to parents who will need to fork out an additional $115 per month. Parents will not be allowed to opt out of the program unless their child is in the infant program.

The department’s budget also included a significant jump in salaries after council approved the department’s request to add a new management position in October. The new position will have zero impact on the municipal budget because of a $25,000 annual increase in provincial funding from Family and Community Support Services and a $20,000 reduction in rent.

Protective Services

2017 budget: $803,320

Increase: $28,152 or 0.39 per cent

The protective services department will require about $803,000 in municipal taxes, including an additional $28,153 in 2017 in order to cover an increase in salaries and a general increase in costs.

On the revenue side the department collected $45,000 in parking fines last year and estimates it will collect $20,000 more in 2017 due to an increase in traffic when entrance to the park is free in 2017 to celebrate Canada’s 150th anniversary.

The department also projects it will collect an additional $5,600 in 2017 through fees for sidewalk seating, which was officially approved in April.

From its capital budget, the department would like to spend $198,000 to buy a variety of equipment in 2017, including a new set of hydraulic spreaders, a new computer server and a half-ton truck for the bylaw department, among other capital expenses.

Its biggest capital request in 2017 is $125,000 to buy 12 new self-contained breathing apparatuses. The department intends to buy another 12 in 2018.

The remaining $1.1 million collected in taxes is budgeted for land rent and planning, which is paid to Parks Canada, as well as funds for the environmental stewardship program, the library and cultural centre, the Jaser-Yellowhead Museum and Achieves, Jasper Community Housing Corporation and general capital.